At present, Silicon Valley Bank(SVB) fallout is a hot topic. Few days before collapse, SVB was ranked among Forbes America’s Best Banks List. Many news articles, videos and people have explained and analyzed the reasons and impacts of SVB fallout. One important point which catches my eyes & most others can relate is the standard insurance amount. In case of SVB, the standard insurance amount is $250K per depositor as per FDIC. The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks.

What’s a safety net in India? How to minimize risk exposures?

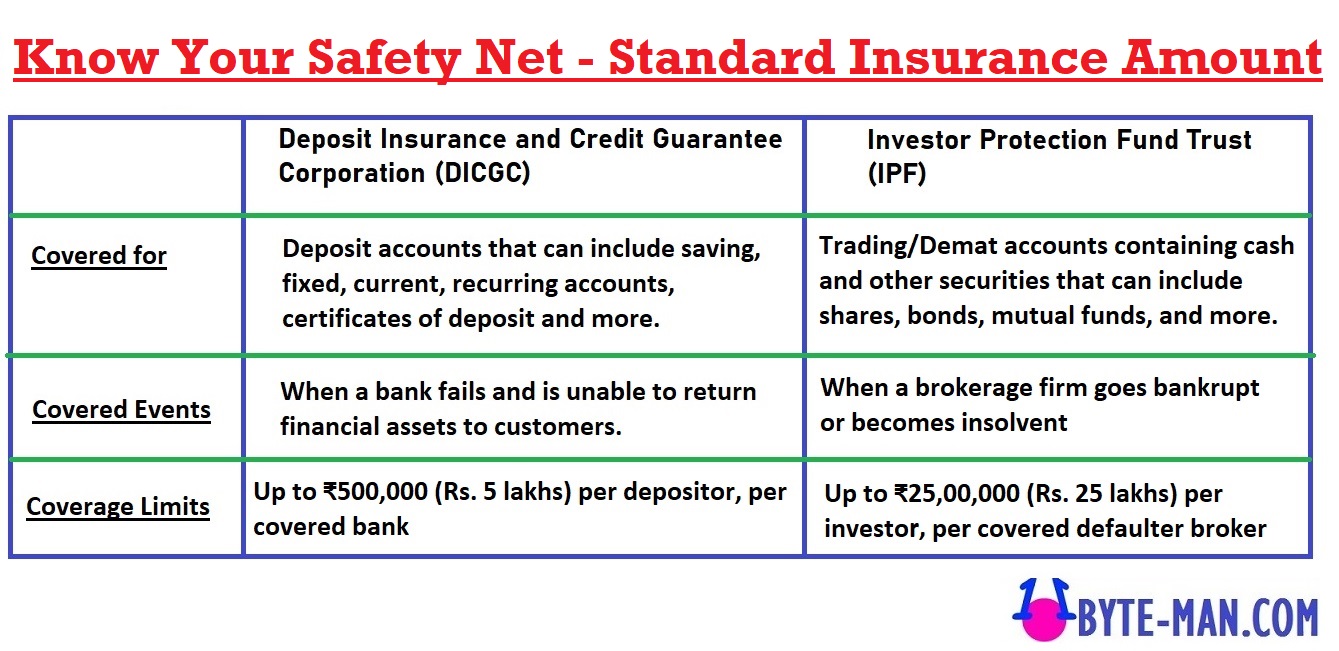

In India, DICGC(Deposit Insurance and Credit Guarantee Corporation) insures all bank deposits, such as saving, fixed, current, recurring deposit for up to the limit of ₹500k of each depositor in a bank. The previous limit of ₹100k was increased to ₹500k in 2020. In simple language, in case the bank goes bankrupt, then he/she can avail only ₹ 5 lakhs, including principal and interest amount, even if the net deposit amount held by an individual or same entity in that one bank exceeds ₹ 5 lakhs. (For example, single account & joint account are different entities. The different combinations of joint holders are even different entities. For more details visit below links.)

Furthermore, in India, in the case of a trading demat account, the Investor Protection Fund Trust (IPF) is used to refund investors who lose money in the event of a brokerage firm going bankrupt or becoming insolvent. Investors are paid up to a maximum limit of ₹ 25 lakhs per investor per defaulter/expelled member in respect of claims arising on expulsion/declaration of default of members under this arrangement.

Read below articles(provided links) to know what the rules are and how you can minimize your “personal” deposited amount risk exposure by not putting all money in one account.

Very useful links:

https://www.dicgc.org.in/FD_A-GuideToDepositInsurance.html

https://m.rbi.org.in//scripts/FS_FAQs.aspx?Id=64&fn=2

https://www.nseindia.com/invest/investor-protection-fund-trust